本帖最后由 闲云野鹤 于 2020-1-22 19:12 编辑

老王是个程序员,四十岁了,干了十几年合同工累了,最近找了个政府工金饭碗,今后再也不用为退休金发愁了。

一看工资恍然大悟,难怪那些新毕业的程序员看不上政府工呢,工资低还要熬年头,还不如到硅谷去干几年就退休了。

https://www.tbs-sct.gc.ca/agreements-conventions/view-visualiser-eng.aspx?id=1#tocxx312259

用这个计算器可以算出退休后的年金

http://apppen-penapp.tpsgc-pwgsc.gc.ca/penavg-penben_prod/cpr-pbc/accueil-welcome/prep.action

四十岁加入政府,65岁退休,干满25年,工资算最后五年平均值8万,退休后年金$30,828.12。加上CPP/QPP和以前存的RRSP可以安享晚年了。

Regular retirement benefit : Immediate annuityBenefits options | Annual | Monthly | Effective from date | Age | Effective to date | | $30,828.12

| $2,569.01

| 2045/01/01

| 65

|

| Bridge benefit

(Up to age 65) | N/A

| N/A

| N/A

| N/A

| N/A

| Estimated pension value | $30,828.12

| $2,569.01

| |

老王是个认真的人,一定要搞清楚这个数字是怎么来的呢?

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/retirement-income-sources.html

这里提到了上班期间每年要交多少钱? 除了要交CPP/QPP部分,还要交政府工的养老金部分。

想要60岁就退休拿全额养老金得交这么多钱。(If you were participating in the plan on or before December 31, 2012, you are eligible to draw an unreduced pension benefit at age 60 with at least two years of pensionable service (or age 55 with 30 years of pensionable service)

想要65岁退休拿全额养老金得交这么多钱。(If you begin to participate in the plan on or after January 1, 2013, you are eligible to draw an unreduced pension benefit at age 65 with at least two years of pensionable service (or age 60 with 30 years of pensionable service).

等老王65岁后每年可以拿这么多养老金:

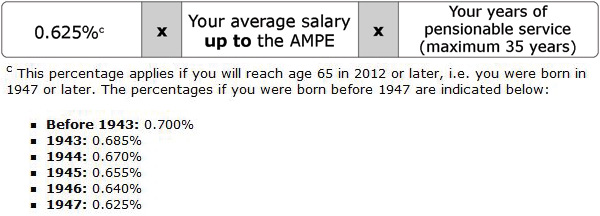

比如退休前最高连续五年平均工资是8万。工作25年。AMPE is 最后五年平均 YMPE 。The maximum level is set every year by the CPP/QPP and is known as the Year's Maximum Pensionable Earnings (YMPE). In 2020, it is set at $58,700.

假设2045年老王退休时AMPE 是60,000.

1.375%*60,000*25=20,625

2%*(80,000-60,000)*25=10,000

20,625+10,000=30,625

这个数跟上面计算器算出的很接近了。再精确点,就按AMPE是58,700算

1.375%*58,700*25=20,178.12

2%*(80,000-58,700)*25=10,650

20,178.12+10,650=30,828.12--------------------》完美匹配计算器。

看看这些年的YMPE涨幅:

https://www.canada.ca/en/revenue-agency/services/tax/registered-plans-administrators/pspa/mp-rrsp-dpsp-tfsa-limits-ympe.html, 几乎是每年涨2.x%。 政府工的工资也会根据通货膨胀每年涨个2.*%.

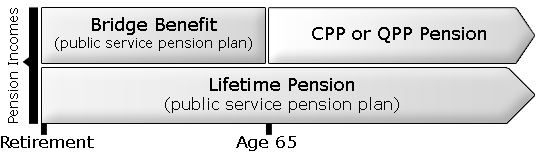

如果想在65岁之前退休,就可以拿bridge benefit:

Bridge benefitIf you retire before age 65, you will also receive a bridge benefit. This temporary benefit helps "bridge" your pension until age 65, when CPP/QPP is expected to begin. However, the bridge benefit will stop immediately if you become entitled to CPP/QPP disability pension. The following table illustrates how your bridge benefit is calculated. Figure 5: Bridge benefit calculation (full-time)

比如老王到2040年就不想干了,那时才干了20年。离65岁拿全额CPP/QPP还有五年。

Calculation of lifetime pension and bridge benefit – Applying for a normal CPP/QPP pension(老王觉得这个图里的lifetime pension 只包括2012年底前加入计划的,如果是2013年后加入的,life time pension 只能65岁后拿. 如果是2013年后加入的,life time pension 可以换成减掉额度的annual allowance, 就可以从55岁拿起)

用计算器算出60岁退休,干20年,60-65岁期间退休金每年32000,65岁之后每年24662. ( 老王觉得这个bridge effective from date 是错的,而且不必把两个数加起来,也就是60-65之间只有brdige, 65岁之后bridge 停发,才有deferred annuity 延迟年金)Regular retirement benefit : Deferred annuityBenefits options | Annual | Monthly | Effective from date | Age | Effective to date | | $24,662.50

| $2,055.21

| 2045/01/01

| 65

|

| Bridge benefit

(Up to age 65) | $7,337.50

| $611.46

| 2045/01/01

| 65

| 2045/01/31

| Estimated pension value | $32,000.00

| $2,666.67

| |

Regular retirement benefit : Annual Allowance( 老王觉得这个结果是错的,他只考虑了2012年以前参加计划的人。)Benefits options | Annual | Monthly | Effective from date | Age | Effective to date | | $24,662.50

| $2,055.21

| 2040/01/01

| 60

|

| | $7,337.50

| $611.46

| 2040/01/01

| 60

| 2045/01/31

| Estimated pension value | $32,000.00

| $2,666.67

| Early Retirement Reduction |

|

假设2040年老王退休时AMPE 是58700. 工资还是80,000. 那么在60-65岁期间可以每年拿这个金额:

0.625%58700*20=7337.5---》bridge benefit--------------------》完美匹配计算器

life time pension 重新算:只有20年了:

1.375%*58,700*20=16,142.5

2%*(80,000-58,700)*20=8520

lifetime pension =16142.5+8520=24662.5--------------------》完美匹配计算器

但这个life time pension 不能60岁一退休就拿,而是等到65岁才能拿。

在60-65岁期间每年只拿bridge benefit 7337.5

65岁之后每年拿deferred annuity: 24662.5

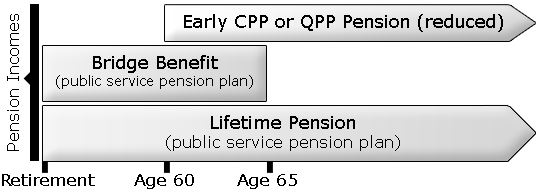

如果老王想从60岁开始拿CPP/QPP, 那就不是全额了,而是每个月少拿0.6%, 五年60个月 只能拿100-0.6*60=64% early CPP/QPP pension.

(老王觉得这个图里的lifetime pension 是减掉额度的annual allowance)

Calculation of lifetime pension and bridge benefit – applying for an early CPP/QPP Pension

如果60岁退休计算器还有个结果: annual allowance.

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/annual-allowance.html#toc1

Regular retirement benefit : Annual AllowanceBenefits options | Annual | Monthly | Effective from date | Age | Effective to date | | $24,662.50

| $2,055.21

| 2040/01/01

| 60

|

| | $7,337.50

| $611.46

| 2040/01/01

| 60

| 2045/01/31

| Estimated pension value | $32,000.00

| $2,666.67

| Early Retirement Reduction |

|

Type of pension benefits for plan members who began participating in the plan on or after January 1, 2013Types of pension benefits for plan members who began participating in the plan on or after January 1, 2013 - Based on age and pensionable service

If you are | And leave the public service with … of pensionable service | You will be entitled to | | Age 65 or over | At least 2 years | An immediate annuity your accrued pension calculated according to the pension formula, payable immediately. Since you are age 65 or over, you will only receive the lifetime pension; the bridge benefit will not be paid | | Age 60 or over | At least 30 years | An immediate annuity | | Age 55 up to 65 | At least 2 years | A deferred annuity your accrued pension calculated according to the pension formula, payable at age 65

or

An annual allowance a permanently reduced pension, payable as early as age 55 and before age 65 |

原来退休在55岁到65岁之间的话如果超过两年服务的话有两种选择:

A deferred annuity your accrued pension calculated according to the pension formula, payable at age 65(推迟到65岁拿钱)

or

An annual allowance a permanently reduced pension, payable as early as age 55 and before age 65(一退休就拿钱但是要减掉一个额度)

额度公式:

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/annual-allowance.html#toc2

Pension eligibility at age 65 - Pension reduction according to years of serviceIf you have completed the following years of service | And have reached age | Your annual allowance is reduced by the following amount | 25 or more | 55 but are under age 60 | The greater of: - 5% for each year you are younger than age 60 (rounded to the nearest one tenth of a year) or

- 5% for each year that your pensionable service is less than 30 years (rounded to the nearest one tenth of a year)

| | 60 but are under age 65 | The lesser of: - 5% for each year you are younger than age 65 (rounded to the nearest one tenth of a year) or

- 5% for each year that your pensionable service is less than 30 years (rounded to the nearest one tenth of a year)

| Less than 25 | 55 but are under age 65 | 5% for each year you are under age 65 (rounded to the nearest one tenth of a year) |

老王干到60岁才20年不够25年,额度百分比是5%每年*(65-退休年龄)=5%*(65-60)=25%

如果老王选的是annual allowance这种方式,bridge benefit 不变,还是60-65岁拿 bridge benefit. 然后从60岁开始一直拿annual allowance.

假设2040年老王退休时AMPE 是58700. 工资还是80,000. 那么在60-65岁期间可以每年拿这个金额:

0.625%58700*20=7337.5---》bridge benefit--------------------》完美匹配计算器

annual allowance 是life time pension-额度:额度是减掉25%:

1.375%*58,700*20=16,142.5

2%*(80,000-58,700)*20=8520

lifetime pension =16142.5+8520=24662.5--------------------》完美匹配计算器

额度=24662.5*25%=6165.63

annual allowance=24662.5-6165.63=18496.87----->跟计算器完全不同

这个annual allowance60岁一退休就拿,18496.87

在60-65岁期间每年只拿bridge benefit 7337.5

如果活到100岁,用deferred annuity 的方式 一共拿这么多钱:

1 bridge benefit: 5*7337.5=36687.5

2. deferred annuity: (100-65)*24662.5=863187.5

用annual allowance 的方式一共拿这么多:

1 bridge benefit: 5*7337.5=36687.5

2. annual allowance: (100-60)*18496.87=739874.8, 比第一种方式少了123312.7元。

如果寿命是超过80岁,deferred annuity方式更好。少于80岁,annual allowance 更好。

那为啥annual allowance 自己算的跟计算器差了这么多呢?老王对自己的逻辑还是有信心的,干了这么多年的编程和找bug,这种小学数学不可能出错,问题出在哪呢?经过反复研究政策及google别的政府网站,发现了是计算器出错了。他只考虑了2012年以前参加计划的人。

这个链接更详细介绍2013年之后的计划

http://psacunion.ca/sites/psac/files/attachments/pdfs/psac-group-2-retirement-tips-en.pdf

这里介绍2012之前和之后的区别: 2012年12月31日之前参加计划的可以60岁就拿全部的immdiate annuity,没有减去额度。所以计算器算出 annual allowance和deferred annuity是一样的。旧计划是50岁就可以拿annual allowance了,新计划(2013后加入)要55岁才能拿annual allowance.

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/annual-allowance.html#toc1

Figure 1: Pension eligibility at age 60 - Pension reduction according to years of serviceIf you have completed the following years of service | And have reached age | Your annual allowance is reduced by the following amount | 25 or more | 50 but are under age 55 | The greater of: - 5% for each year you are under age 55 (rounded to the nearest one tenth of a year) or

- 5% for each year that your pensionable service is less than 30 years (rounded to the nearest one tenth of a year)

| | 55 but are under age 60 | The lesser of: - 5% for each year you are under age 60 (rounded to the nearest one tenth of a year) or

- 5% for each year that your pensionable service is less than 30 years (rounded to the nearest one tenth of a year)

| Less than 25 | 50 but are under age 60 | 5% for each year you are under age 60 (rounded to the nearest one tenth of a year) |

老王的头已经昏了,算了,到时再说啥时退休吧,万一儿子生了三胞胎要提前退休去照顾呢?

过了几天老王想明白了,退休后几乎十几年的退休金就是自己这25年存入的钱取出来的,可以用这个计算器算一下:

The contribution rates as of January 1, 2020, for plan members who are eligible to receive an unreduced pension at age of 65 are: - 8.69 % on the portion of salary up to the maximum covered by the CPP/QPP (YMPE); and

- 10.15 % on the portion of salary above the maximum covered by the CPP/QPP (YMPE).

假设每年老王工资都是8万:

58700*8.69=5101.03

(80000-58700)*10.15%=2161.95

5101.03+2161.95=7262.98------------》每年投入的钱

7262.98/12=605.25---->每月投入的钱

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

payments=7262.98

annual rate=3%

periods=25

compunding=annually

click future vlaue FV得出--264,802.91

然后把-264,802.914填入present value

rate=3%

future value 清除

period =10

compunding=annually

click payment PMT 得出31,042.98-------------》每年可以拿的钱

这里假设投资利率是3%, 如果不在政府打工,每年强制自己投资7262元RRSP退休基金的话,也可以拿到退休后10年的钱,每年31042. 但是如果寿命超过65+10=75的话,自己投的RRSP钱拿完了,就只能靠OAS+CPP/QPP 了,自己也可以决定每年少拿点,比如想退休后拿够25年,那就在上面计算器把period 改为25, 点PMT 就变成了15,207元。

政府的计划相当于一个大的水池,每年源源不断得有新的员工加入这个大水池,自己投资的钱拿完了可以用别人贡献的。而自己的RRSP只有自己的小水池,没有新水源源不断得供应。

想明白了这些老王决定要好好锻炼身体了。。。。

|