本帖最后由 闲云野鹤 于 2024-3-28 15:46 编辑

分红有两种: eligible or non-eligible.

https://filingtaxes.ca/differenc ... eligible-dividends/

Taxable amount of dividendsTaxable amount of dividends

(eligible and other than eligible) | Taxable amount of dividends

(other than eligible) | Enter on line 12000 of your return the total of the amounts shown on the following slips: | Enter on line 12010 of your return the total of the amounts shown on the following slips: |

计算应税收入:分红收入Gross-up,

Taxable amount of dividends if you did not receive an information slipEligible dividends | Other than eligible dividends | | Multiply the actual amount you received by 138% | Multiply the actual amount you received by 115% | | Include this amount on line 12000 of your return | Include this amount on line 12000 and line 12010 of your return |

联邦报税时分红的免税额:

Line 40425 – Federal dividend tax credit

If you reported dividends on line 12000 of your return, claim on line 40425 of your return the total of the dividend tax credits from taxable Canadian corporations shown on your information slips.

If you did not receive an information slipAmount of eligible dividends | Amount of dividends other than eligible dividends | Multiply the taxable amount of eligible dividends that you reported on line 12000 of your return by 15.0198%. | Multiply the taxable amount that you reported on line 12010 of your return by 9.0301%. |

安省报税的分红免税额:

https://www.taxtips.ca/ontax/dividend-tax-credit.htm

Ontario Dividend Tax Credit for Eligible Dividends

Ontario Dividend Tax Credit Rate for Eligible Dividends | Year | Gross-up | % of Grossed-up

Dividend | % of Actual

Dividend | 2014 & later | 38% | 10.0% | 13.800% | 2012/2013 | 38% | 6.40% | 8.832% | 2011 | 41% | 6.40% | 9.024% | 2010 | 44% | 6.40% | 9.216% | 2009 | 45% | 6.40% | 10.730% | 2008 | 45% | 7.00% | 10.150% | 2007 | 45% | 6.70% | 9.715%

|

Ontario Dividend Tax Credit for Non-Eligible DividendsThe current and past Ontario rates for non-eligible dividends are shown in the following table.

Ontario Dividend Tax Credit Rate for Non-Eligible Dividends | Year | Gross-up

Rate | % of

Gross-up | % of Grossed-up

Dividend | % of Actual

Dividend | 2020+ | 15% | 22.8950% | 2.9863% | 3.43% | 2019 | 15% | 25.1950% | 3.2863% | 3.78% | 2018 | 16% | 23.8257% | 3.2863% | 3.81% | 2016-2017 | 17% | 29.50% | 4.2863% | 5.02% | 2014-2015 | 18% | 29.50% | 4.50% | 5.31% | 2010-2013 | 25% | 22.50% | 4.50% | 5.625% | 2008/2009 | 25% | 25.65% | 5.13% | 6.4125%

|

https://www.drtaxconsulting.com/2018/01/992举例,安省居民王女士2017年在TD 银行作了100万元的总投资,由于投资经理比较专业,2017年取得分红收入51594元。假如王女士2017年没有其它收入,那么这51594元投资收入应交多少收税呢? 第一步,确定分红收入为EIGIBLE DIVIDNEDS 第二步,计算应交的联邦税 a)计算应税收入:分红收入Gross-up, 即51594*1.38=71200 b)联邦应交税: 45916*15%+(71200-45916)*20.5%=12070 c)计算免税额: 2017年个人基本免税额1745加上分红免税额10694,共12439元 d)因为b小于c,所以应交联邦税为零 第三步,计算安省省税 a)计算应税收入: 分红收入Gross-up, 即51594*1.38=71200 b)安省应交税: 42201*5.05%+(71200-42201)*9.15%=4784 c)计算免税额:安省个人免税额514加上安省分红免税额7120,共7634 d)因为c小于d,最后应交安省税为零。 聪明的读者会发现,这5万多元的分红收入,本来是会产生应缴税的,但是被个人免税额和分红免税额完全吸收,导致最终王女士的税负为零。 2017年王女士虽然不用交所得税,但是必须交600元安省健康保险。 假如王女士收到的分红收入不是EIGIBLE DIVIDNES, 只要此分红收入低于33309元,并且当年没有其它收入,最终税负也是零(安省健康保险300元除外)。

https://www.drtaxconsulting.com/2018/02/1016

T3/T5/T5008 上面反映的收入,哪种最省税? 下面以常见的资本增值收入,分红收入(EIGIBLE)和利息收入举例说明。

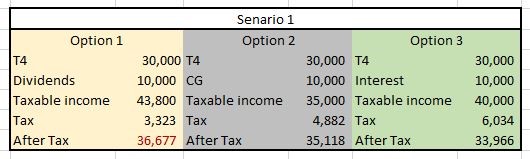

例1(见文末Scenario 1):王先生2017年工资收入3万元,收到1万元分红收入或资本增值收入或利息收入,哪种收入对王先生最好呢?

很明显,分红收入最好, 因为税后收入最多,其次是资本增值收入,最后是利息收入。

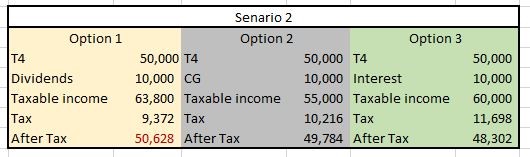

例2(见文末Scenario 2):王先生2017年工资收入5万元,收到1万元分红收入或资本增值收入或利息收入,哪种收入对王先生最好呢? 很明显,分红收入最好,因为税后收入最多,其次是资本增值收入,最后是利息收入。

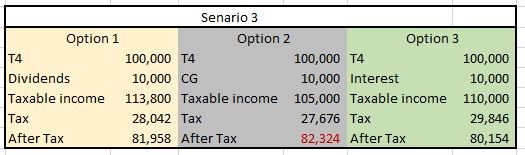

例3(见文末Scenario 3):王先生2017年工资收入10万元,收到1万元分红收入或资本增值收入或利息收入,哪种收入对王先生最好呢? 很明显,资本增值收入最好,因为税后收入最多,其次是分红收入,最后是利息收入。

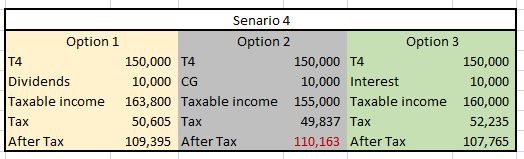

例4(见文末Scenario 4):王先生2017年工资收入15万元,收到分红收入或资本增值收入或利息收入,哪种收入对王先生最好呢? 很明显,资本增值收入最好,因为税后收入最多,其次是分红收入,最后是利息收入。

从上面的4个例子可以得出结论:如果个人总的收入低于5万元,那么分红收入最好(要问为什么,可查阅《加拿大税务观察》第117期“投资分红收入低于51594元,可以一分钱税不用交”),其次是资本增值收入,最差的是利息收入。如果个人收入高于5万元,比如10万元或更高,那么资本增值收入最好,其次是分红收入,最差的是利息收入。因此纳税人在投资过程中,应该多考虑资本增值收入或分红收入,相对而言它们的税负会低一些,而利息收入会100%计入应税收入,税负最高,尽量避免。

https://www.taxtips.ca/dtc/eligible-dividends/eligible-dividend-tax-credit-rates.htm

Federal & Provincial/Territorial Dividend Tax Credit Rates for Eligible DividendsEligible Dividend Tax Credit Rates

as a % of Grossed-up Taxable Dividends | Year | Gross-

up | Federal | AB(12) | BC(7) | MB(8) | NB(2) | NL(1) | NS(4) | NT(6) | NU | ON(9) | PE(3) | QC(11) | SK(10) | YT(5) | 2022/23 | 38% | 15.0198% | 8.12% | 12% | 8% | 14% | 6.3% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.70% | 11% | 12.02% | 2021 | 38% | 15.0198% | 8.12% | 12% | 8% | 14% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.70% | 11% | 12.02% | 2020 | 38% | 15.0198% | 10% | 12% | 8% | 14% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.70% | 11% | 12.02% | 2019 | 38% | 15.0198% | 10% | 12% | 8% | 14% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.78% | 11% | 12.02% | 2018 | 38% | 15.0198% | 10% | 10% | 8% | 14% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.86% | 11% | 12.02% | 2017 | 38% | 15.0198% | 10% | 10% | 8% | 14% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.9% | 10.75% | 15.0% | 2016 | 38% | 15.0198% | 10% | 10% | 8% | 13.5% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.9% | 11% | 15.0% | 2015 | 38% | 15.0198% | 10% | 10% | 8% | 12% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.9% | 11% | 15.0% | 2014 | 38% | 15.0198% | 10% | 10% | 8% | 12% | 5.4% | 8.85% | 11.5% | 5.51% | 10.0% | 10.5% | 11.9% | 11% | 15.08% | 2012/13 | 38% | 15.0198% | 10% | 10% | 8% | 12% | 11% | 8.85% | 11.5% | 5.51% | 6.4% | 10.5% | 11.9% | 11% | 15.08% | 2011 | 41% | 16.4354% | 10% | 10.31% | 11% | 12% | 11% | 8.85% | 11.5% | 5.82% | 6.4% | 10.5% | 11.9% | 11% | 15.08% | 2010 | 44% | 17.9739% | 10% | 10.83% | 11% | 12% | 11% | 8.85% | 11.32% | 6.11% | 6.4% | 10.5% | 11.9% | 11% | 10.83% | 2009 | 45% | 18.9655% | 10% | 11% | 11% | 12% | 9.75% | 8.85% | 11.5% | 6.21% | 7.4% | 10.5% | 11.9% | 11% | 11% | 2008 | 45% | 18.9655% | 9.0% | 12% | 11% | 12% | 6.65% | 8.85% | 11.5% | 6.20% | 7.0% | 10.5% | 11.9% | 11% | 11% | 2007 | 45% | 18.9655% | 8.0% | 12% | 11% | 12% | 6.65% | 8.85% | 11.5% | 6.20% | 6.7% | 10.5% | 11.9% | 11% | 11% |

Eligible Dividend Tax Credit Rates

as a % of Actual Dividends | Year | Gross-

up | Federal | AB(12) | BC(7) | MB(8) | NB(2) | NL(1) | NS(4) | NT(6) | NU | ON(9) | PE(3) | QC(11) | SK(10) | YT(5) | 2022/23 | 38% | 20.73% | 11.20% | 16.6% | 11.04% | 19.32% | 8.69% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.15% | 15.18% | 16.59% | 2021 | 38% | 20.73% | 11.20% | 16.6% | 11.04% | 19.32% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.15% | 15.18% | 16.59% | 2020 | 38% | 20.73% | 13.8% | 16.6% | 11.04% | 19.32% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.15% | 15.18% | 16.59% | 2019 | 38% | 20.73% | 13.8% | 16.6% | 11.04% | 19.32% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.26% | 15.18% | 16.59% | 2018 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 19.32% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.37% | 15.18% | 16.59% | 2017 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 19.32% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.42% | 14.84% | 20.70% | 2016 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 18.63% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.42% | 15.18% | 20.70% | 2015 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 16.56% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.42% | 15.18% | 20.70% | 2014 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 16.56% | 7.45% | 12.21% | 15.87% | 7.60% | 13.8% | 14.49% | 16.42% | 15.18% | 20.81% | 2012/13 | 38% | 20.73% | 13.8% | 13.8% | 11.04% | 16.56% | 15.18% | 12.21% | 15.87% | 7.60% | 8.83% | 14.49% | 16.42% | 15.18% | 20.81% | 2011 | 41% | 23.17% | 14.1% | 14.53% | 15.51% | 16.92% | 15.51% | 12.48% | 16.22% | 8.20% | 9.02% | 14.81% | 16.78% | 15.51% | 21.26% | 2010 | 44% | 25.88% | 14.4% | 15.60% | 15.84% | 17.28% | 15.84% | 12.74% | 16.30% | 8.80% | 9.22% | 15.12% | 17.14% | 15.84% | 15.60% | 2009 | 45% | 27.50% | 14.5% | 15.95% | 15.95% | 17.40% | 14.14% | 12.83% | 16.68% | 9.00% | 10.73% | 15.23% | 17.26% | 15.95% | 15.95% | 2008 | 45% | 27.50% | 13.05% | 17.40% | 15.95% | 17.40% | 9.64% | 12.83% | 16.68% | 8.99% | 10.15% | 15.23% | 17.26% | 15.95% | 15.95% | 2007 | 45% | 27.50% | 11.60% | 17.40% | 15.95% | 17.40% | 9.64% | 12.83% | 16.68% | 8.99% | 9.72% | 15.23% | 17.26% | 15.95% | 15.95% |

Prior to 2006, there was only one type of dividend, and the dividend gross-up was 25%.

Ontario Dividend Tax Credit Rate for Non-Eligible DividendsYearGross-up

Rate% of

|